Forex trading, also known as foreign exchange trading, is one of the most active financial markets globally, with a daily trading volume exceeding $6 trillion. It involves the exchange of one currency for another, making it a vital component of international trade and investment. This guide explores what forex trading is and how it operates, shedding light on why it has become a Forex Trading financial activity.

Understanding Forex Trading

At its core, forex trading revolves around the buying and selling of currency pairs. A currency pair consists of two currencies, such as EUR/USD (Euro/US Dollar), where the first currency is the “base currency” and the second is the “quote currency.” When trading forex, you’re essentially predicting whether the base currency will strengthen or weaken against the quote currency.

For instance, if you believe the Euro will appreciate against the US Dollar, you would buy the EUR/USD pair. Conversely, if you expect the Euro to weaken, you would sell the pair. The goal is to profit from changes in the exchange rates.

How Does Forex Trading Work?

Forex trading takes place in a decentralized market, meaning it operates 24 hours a day, five days a week. The forex market runs through a network of banks, brokers, and financial institutions rather than a centralized exchange. This global accessibility allows traders to participate at almost any time, making forex highly flexible compared to traditional stock markets.

Leverage and Margin

Leverage is a standout feature in forex trading, enabling traders to control larger trades with a relatively small initial investment, known as the margin. For instance, with a leverage of 50:1, you could control $50,000 in trading capital with just $1,000 from your own funds. While leverage amplifies potential profits, it also significantly increases risk, making it crucial for traders to use it wisely.

Forex Trading Tools and Technology

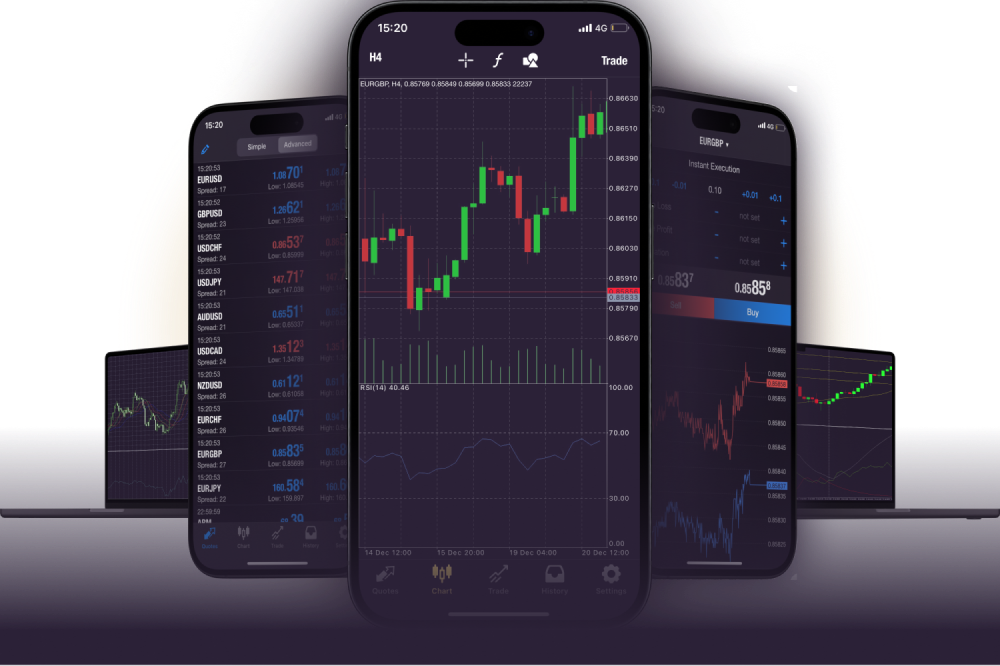

Modern technology has made forex trading accessible to almost everyone. Trading platforms such as MetaTrader 4 and 5 allow traders to execute trades, monitor financial news, and analyze price charts directly from their devices.

Why is Forex Trading Popular?

Forex trading’s popularity is linked to its high liquidity, diverse trading opportunities, and the potential for substantial profits if done correctly. Many investors are also drawn to its global nature and the possibility of earning income beyond traditional investment avenues.

Forex trading can be both exciting and rewarding, but it requires careful planning, education, and risk management. Whether you’re a beginner or an experienced trader exploring new opportunities, understanding the mechanics of how forex works is key to navigating this dynamic market.